Payday Loans – Millions of people globally survive paycheck to paycheck, and it is common for them to run out of money before the next paycheck arrives. Life is unpredictable and if any emergency arises, they may not be able to afford to take care of it. Securing a loan is something most people will consider in such a scenario, but if you do not have a strong credit history, you will not be eligible to secure a traditional loan via a bank. But worry not as plenty of lenders are willing to offer you a payday loan with severe terms to ensure your emergency is taken care of.

A payday loan is quite popular with Americans for the same reason and you should learn more about it before you think of applying for one.

Table of Contents

What Are Payday Loans:

A payday loan is a collateral-free short-term loan that you must repay by your next payday. The amount you apply for is generally very less which is why lenders agree to offer borrowers a payday loan even when they have a bad credit score. But the increased risk that lenders take cover by charging a higher interest rate for the loan. Because of this, financial advisors discourage borrowers from applying for a payday loan if it is not needed.

When you apply for a personal loan, the repayment is divided into several parts that you may pay monthly, but you can identify a payday loan as a one-time repayment loan where you repay the entire loan amount plus the fees at a go.

How Payday Loan Works:

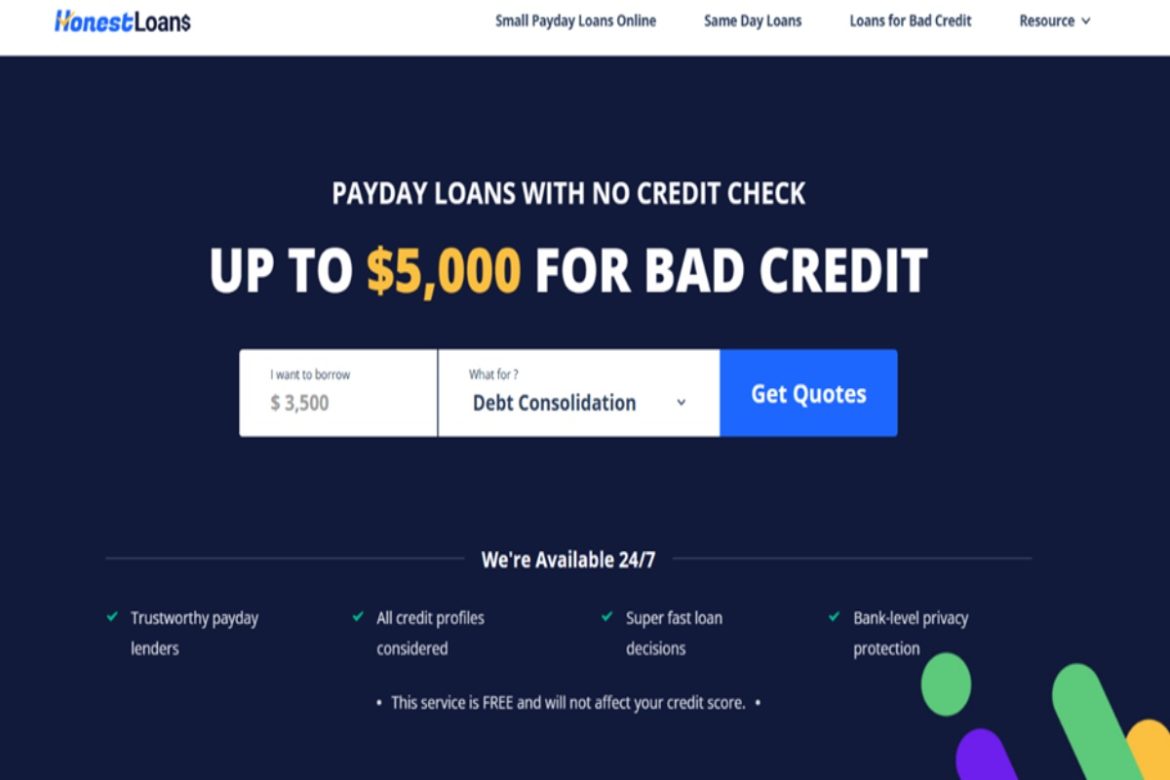

Payday loan was typically obtained at a brick-and-mortar location earlier, but thanks to the evolution of the internet, you can now easily secure a payday loan online. You need not reach out to individual lenders as platforms such as Honest Loans can help you connect with their vast network of reputed lenders who are willing to offer you a payday loan at fair terms even when you have a bad credit score. If you have an urgent medical bill payment or your car needs a quick repair, you can visit to get payday loans on Honest Loans.

You have to take into consideration that payday loans are regulated by both federal and state laws and many states have laws that limit the interest rates charged by the lenders. A few states have banned payday loans entirely.

How Can You Apply for a Payday Loan with Bad Credit:

Applying for a payday loan today, even when your credit score is bad, is no big deal. Honest Loans offers to connect you with 80+ trusted lenders. Their user-friendly website can be used to fill out a single loan application form that can connect you with multiple lenders. Their state-of-the-art algorithm helps you link with the right lenders who have a high probability of accepting your loan application and giving you the loan amount at fair terms.

Do not be surprised if you find more than one lender willing to give you a bad credit payday loan. Honest Loans charges no hidden fees for their services and their lenders are transparent about their fees hence this will help you make an informed decision. Read the loan terms carefully and only agree to accept the offer if you are confident that you will be able to repay it back by the next payday. Once you accept the loan, the amount may get deposited into your valid bank account the same day or maximum in 24 hours. Visit Honest Loans to get more details.

Risks of Payday Loans:

While a payday loan may be an easy way to secure a quick loan, you should be aware of the risk involved before you seek one. Their steep borrowing cost can derail you from your financial health. It becomes an issue when you seek a rollover that can affect your credit score and push you into a vicious cycle as the fees of rollover is excessively high. Several lenders offer payday loans at very high fees because it is a short-term loan.

The only way to keep your financial status healthy is to steer clear of a payday loan when it is not that urgent and only agree to take one if you are confident to repay it back by the next payday.

FAQs:

1. Is a credit check a must to get a payday loan?

Most payday lenders do not opt for a hard credit check, but most of them prefer a soft credit check. Though your credit score will not affect their loan lending decision. They will generally give you a loan based on your proof of income.

2. How can I repay the payday loan?

You can either repay the loan by giving the lender a postdated check that they can deposit on your next payday or you can authorize the lender to take the funds from your bank account once your employer pays you.

3. What fees will I be charged for the payday loan?

Payday lenders do not usually charge an interest rate for the loan, but they decide upon a fixed fee that you will have to pay along with the principal loan amount on your next payday.

- What happens if I cannot pay back the loan timely?

If you cannot afford to repay the loan back by your next payday, you can request the lender to offer you a rollover where you just pay the initial borrowing fee until your next paycheck. You will have to pay the original loan plus the additional fee for the rollover. Just be careful, as these fees can rapidly pile up and put you under a huge debt trap.

Conclusion:

Getting a payday loan under the right circumstances can be a great option to deal with an emergency expenditure. If you have a sound financial history and are just in need of some quick cash to cover some expenses, it is ok to get a payday loan.

However, if you are not confident about your ability to repay, then you need to think twice before applying for a payday loan, or else you will push yourself into more debt and ruin your credit score further. If you do not repay the loan back timely, you will have to pay hefty late payment fees, which will be much higher than you can afford. Hence, analyze the idea of accepting a loan only if you can repay it back timely.